In language, palindromes are words or numbers that read the same forward and backward—think “level”, “radar”, or “12321”. At first glance, they seem like quirky linguistic puzzles, fun for brain teasers and wordplay. But what if we told you that palindromes can actually offer valuable insights into the world of finance?

It turns out that these symmetrical gems have more in common with money than you’d think. From balanced portfolios to cyclical markets, palindromes remind us of the patterns, repetitions, and reversals that shape financial thinking.

Let’s explore how palindromes and finance are more connected than they appear.

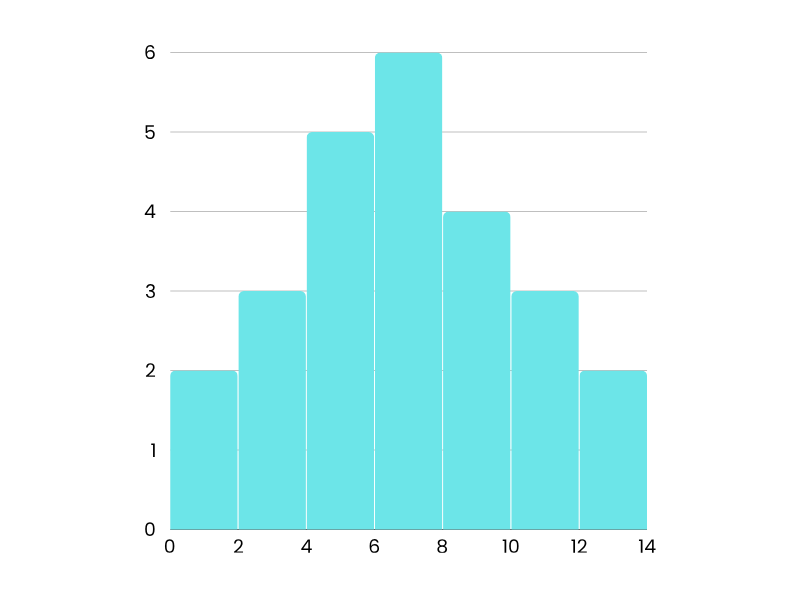

1. Market Cycles: History Repeats Itself

The financial markets are famously cyclical—booms are followed by busts, and recovery often mirrors recession. In many ways, the up-and-down pattern of a market cycle resembles a numerical palindrome like 2002 or 1221—a rise, a fall, then a return.

🔁 Palindrome parallel: Just like “deified” looks the same backward, financial cycles often reflect past trends. Recognizing these patterns can help investors make smarter, more informed decisions.

2. Portfolio Balance: The Symmetry of Smart Investing

A well-structured investment portfolio aims for symmetry—a careful balance between risk and reward, growth and stability. Think of this like a palindrome: each side mirrors the other, creating harmony.

📊 Palindrome parallel: A balanced portfolio is like “civic”—it keeps its shape no matter which way you look at it. Financial advisors aim to create these palindromic structures to withstand market changes from any direction.

3. Financial Discipline: The Power of Reversal

Good financial habits are often about recognizing when to reverse direction—cutting back on spending, reallocating assets, or correcting course after losses. Palindromes are all about reversal too—they live in both directions at once.

🔄 Palindrome parallel: Just as “rotator” flips seamlessly, disciplined investors know when it’s time to pivot—turning short-term setbacks into long-term gains.

4. Compound Interest: Reflective Growth Over Time

Compound interest is a key pillar of financial success, and its growth often follows a predictable pattern. As investments grow, the rate of increase can reflect earlier gains—a kind of mirror effect.

📈 Palindrome parallel: A number like 1441 shows how symmetry can emerge from consistent growth, much like how steady contributions and time can reflect back powerful financial results.

5. Psychology of Money: Human Behavior is Repetitive

One of the biggest drivers in finance isn’t numbers—it’s human behavior. Emotions like fear and greed follow patterns, often repeating over time. In this way, people make the same mistakes over and over—like running in palindromic loops.

🧠 Palindrome parallel: Behavioral finance shows us that humans often act in “palindromic” ways—reacting the same to similar situations, whether markets rise or fall.

6. Crypto and Codes: Palindromes in Digital Finance

In the world of cryptography, which underpins cryptocurrency and blockchain technology, palindromic structures are used in hashing and data verification. Symmetry is critical for ensuring data integrity.

💻 Palindrome parallel: The security of digital assets sometimes relies on symmetrical algorithms—like palindromes in code form—to keep transactions safe and verifiable.

7. Numerical Palindromes: Financial Superstitions and Dates

Believe it or not, some traders and investors find significance in palindromic dates like 02/02/2020. These dates are sometimes viewed as lucky or symbolically strong, prompting more activity in markets.

📅 Palindrome parallel: While not rooted in financial science, the idea of “mirror dates” can influence sentiment and create unusual trading volumes—an example of psychology influencing finance through symmetry.

Final Thoughts: More Than Just Wordplay

Palindromes may seem like playful puzzles, but their underlying idea—symmetry, balance, and reflection—has a surprising amount to offer the world of finance. Whether it’s through mirrored market cycles, balanced portfolios, or the rhythms of investor psychology, palindromes remind us that finance is as much about pattern recognition as it is about numbers.

So next time you see a word like “madam” or a number like 1331, think about your finances. Is your portfolio symmetrical? Are you recognizing repeating behaviors? Are your strategies flexible enough to reverse when needed?

In the end, maybe the path to financial clarity is just like a good palindrome: the same from both sides.